Accounting & Tax

From getting the most out of your tax return, to making sure everything is compliant and on time…It’s tax and accounting, done right.

An Accountant you can trust can be worth their weight in gold. We aim to build that trust with our clients from the very first conversation, by taking the time to understand your unique situation and letting you know what’s going to be required, come tax time.

Tax Compliance

Compliance is key to staying in the tax man’s good books. Using professional accountants to help maintain accurate financial records and keep registrations up to date will ensure that all your tax ducks are in a neat, compliant row.

Tax Planning

We all want to get the most out of our Tax. So let’s identify and implement strategies that can help you manage and minimise your tax, while planning for the next year ahead.

Financial Statements

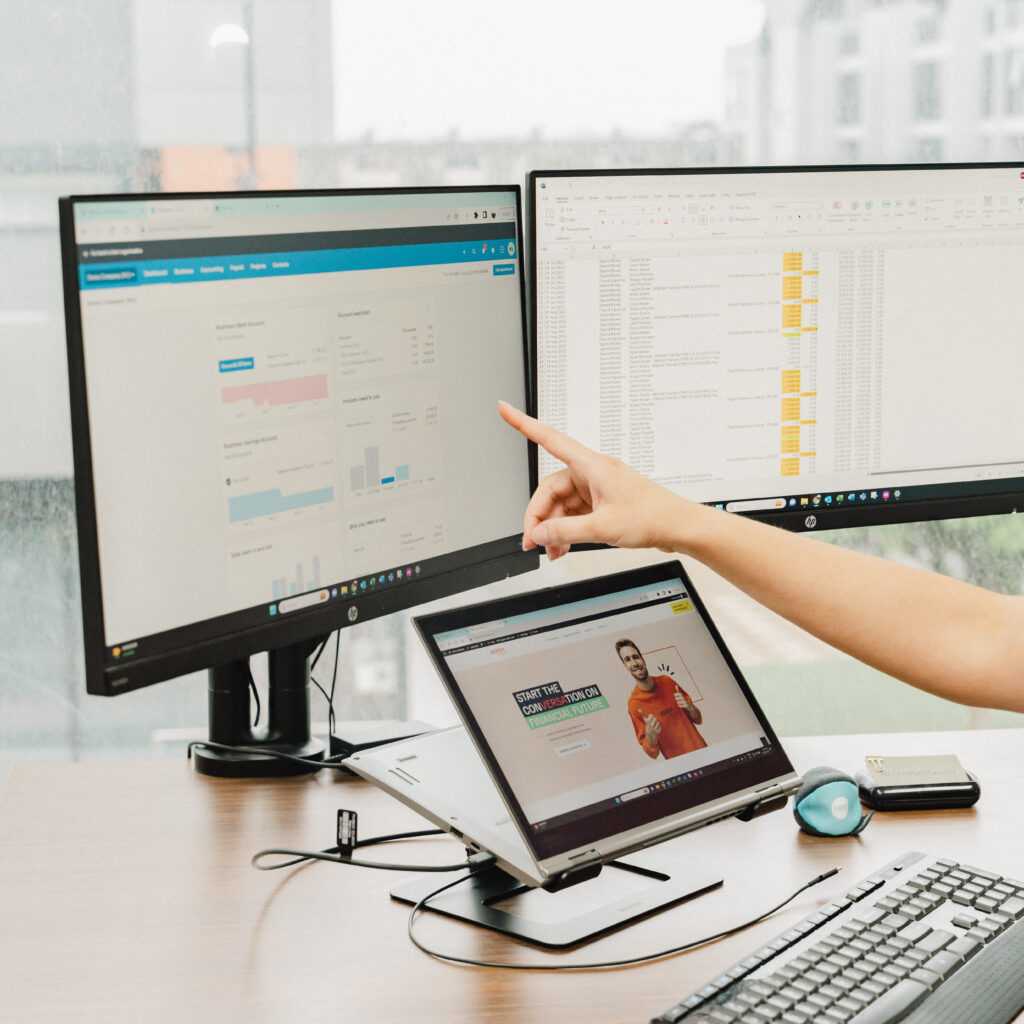

We leverage cloud-based software to meticulously prepare your statements, ensuring your transactions are recorded (and resolved) with ease, presented with precision and of course, polished with a professional touch.

Complex Issues

Sometimes things just seem tricky because we don’t know where to start, or we don’t know what we don’t know. That’s why we’re here to help guide you through some of the more complex accounting issues like business structure, capital gains tax or buying or selling a business. Our focus is always your best outcome.

ATO Correspondence

Let us take the ATO off your plate! From Private Rulings to smoothing out disputes and acing audits, we’ve got your back. Consider us your go-to solution for handling any ATO-related requests that come your way.

BAS/IAS

Reporting the activity of your business while you’re running your business can feel a bit tedious. We’ll keep the process smooth and hassle-free for you by preparing and filing your BAS and IAS, ensuring you’re paying the right amount, right on time.

ACCOUNTING

FOR ALL BUSINESSES

Professional Services

- eCommerce

- Trades

- Health & Fitness

Every business is on its own unique journey, full of twists and turns. That’s where accounting and tax services come in—they’re like your trusty GPS, helping you navigate the financial landscape with ease. Whether you’re in construction or consulting, having a knowledgeable guide on your side makes all the difference. Let us be your financial GPS, guiding you towards success with expertise and reliability.

Features Clients

FREQUENTLY

ASKED QUESTIONS

Why choose VERSA?

VERSA Advisory offers more than traditional accounting services. Beyond the numbers, we focus on your overall business goals, providing a comprehensive range of services, including Accounting and Tax, Business Advisory, Bookkeeping, Mortgage Broking, and Xero Accounting. We’re here to support your business success with a simplified and multifaceted approach.

How much does VERSA Advisory charge for accounting & tax?

We tailor fixed-price packages to suit businesses of all sizes! Book a free 30 minute discovery session with a no obligation quote for help with your accounting and tax.

Do you assist with compliance, reporting, and record-keeping?

Absolutely! If dealing with the ATO feels overwhelming or confusing, our expertise as small business tax and accounting specialists is here to help. We take charge of maintaining records, handling reporting requirements, and ensuring your compliance. Our goal is to provide you with peace of mind when it comes to tax compliance, record-keeping, and financial reporting.

Why outsource accounting and tax preparation services?

Outsourcing accounting and tax preparation services offers access to highly skilled professionals well-versed in current tax regulations and best practices across various fields. VERSA Advisory provides valuable advice, empowering business owners to make informed, data-driven decisions. Outsourcing ensures your financial tasks are handled by experts, staying updated with changes, and allowing you to focus on strategic business decisions.

What does a small business accountant do?

A small business accountant guides you through the intricate Australian tax system, from setting up your business and lodging Business Activity Statements (BAS) to discussing and optimising your business structure. They assist with year-end tax returns, Australian Tax Office (ATO) lodgements, and can help prepare for government grants. Additionally, they offer support for bank finance applications and contribute to the overall growth of your business.